Intel Capital has seen the most IPO or M&A exits since the start of 2009. But SAP Ventures has seen the highest share of its exits come via IPOs.

Armed with big balance sheets and a need to stay ahead of emerging tech trends, corporations are increasingly diving into venture investing for both strategic gain and financial returns. Using CB Insights data, we took a look at which corporate venture capital arms have racked up the most exits since 2009 and of these firms, who has seen the highest share of exits via IPOs vs. M&A.

The data below.

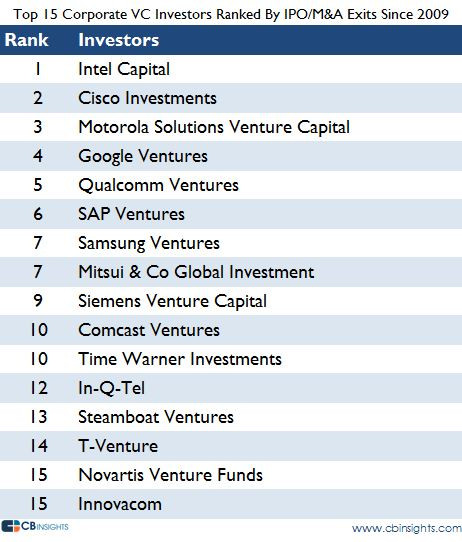

Top 15 Corporate VC Investors By M&A/IPO Exits Since 2009

Since the start of 2009, Intel Capital has realized the highest number of M&A or IPO exits of any investor (corporate or pure-play VC), followed by Cisco Investments and Motorola Solutions Venture Capital. Note: Exits by Comcast Interactive Capital that took place over the period were included under Comcast Ventures.

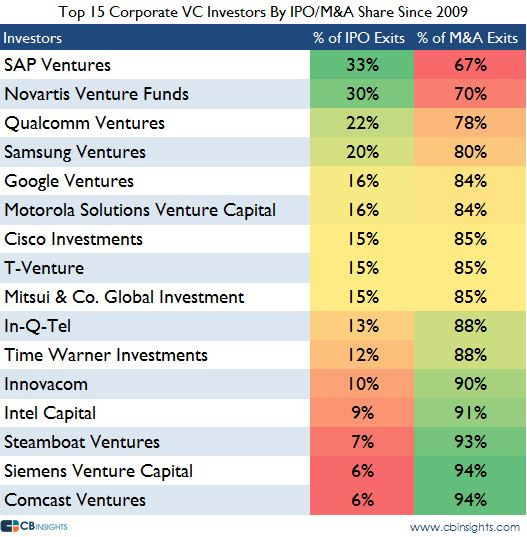

Top 15 Corporate VC Investors By Share of M&A/IPO Exits Since 2009

Of these corporate venture arms, we see that SAP Ventures has notched the highest share of IPO exits including Criteo, Violin Memory and Control4, followed by healthcare corporate VC Novartis Venture Funds. Qualcomm Ventures and Samsung Ventures also saw 1/5 of their exits over their past five years come via public offerings. Google Ventures, the most prolific CVC from a deals perspective over the period, counted RetailMeNot, HomeAway and SilverSpring Networks among the IPOs in its portfolio.

For more corporate venture capital financing and exit data and interactive rankings, check out the CB Insights Venture Capital Database.